The year 2020 will go down in history as one of the worst since the end of WWII. Global economic shocks, pandemics, the rise of totalitarian regimes and the political disintegration of a superpower were all played out against the backdrop of the increasing and unabated progress of climate change.

Help may be on the horizon for COVID-19 and the economic suffering it brought, but there’s no reason to believe that 2021 will mark the end of our pain.

We need to be prepared for a long slog.

The Global Economy

Not since 1870 have so many countries seen their economies shrink. The World Bank reports that advanced economies will likely have shrunk by 7 percent by year’s end. Emerging and developing economies are expected to have contracted by 2.5 percent. That would make 2020 the worst for them in 60 years.

Shipping, travel, air and international land transport have all experienced massive disruptions. Not only are people buying less, it’s taking longer to get goods of all kinds from one place to the next.

Ongoing trade wars and supply chain disruptions are also contributing to a dismal outlook, the World Bank says.

The best-case scenario for the coming year is a return to relative stability in international relations, and a concerted international effort to eradicate COVID-19 and relieve the restrictions that the pandemic has imposed on us and our economies.

If that happens, the World Bank estimates a modest growth rate of 4.2 percent.

But this isn’t certain. International and domestic stresses may make things worse before they get better. Debt distress could set in, domestic policies and freedoms might not bounce back. Trade restrictions and international tensions could continue, or even worsen.

Developing countries are especially vulnerable to these risks. One forecast suggests that the impact of global recession alone could result in a contraction of as much as 6 percent. The downside could be almost 9 percent for the worst affected.

Vanuatu’s Economy

The impact of the COVID-19 crisis on Vanuatu’s economy is hard to know with any certainty. The Department of Finance and Treasury’s monthly financial reports have been unavailable since March, and no formal economic summary has been provided since the mid-year report in August last year.

Finance Minister Johnny Koanapo offered some insight into GDP impacts and outlooks in his budget speech to parliament in November, but questions have been raised about the validity of the GDP estimates and projections. Mr Koanapo’s numbers did not match the numbers in the mid-year report, and his projections are based on assumptions that are unlikely to come about in the year ahead.

The 2021 budget narrative document is expected any day now, and when that is released, it will contain accurate revenue and expenditure information for 2020.

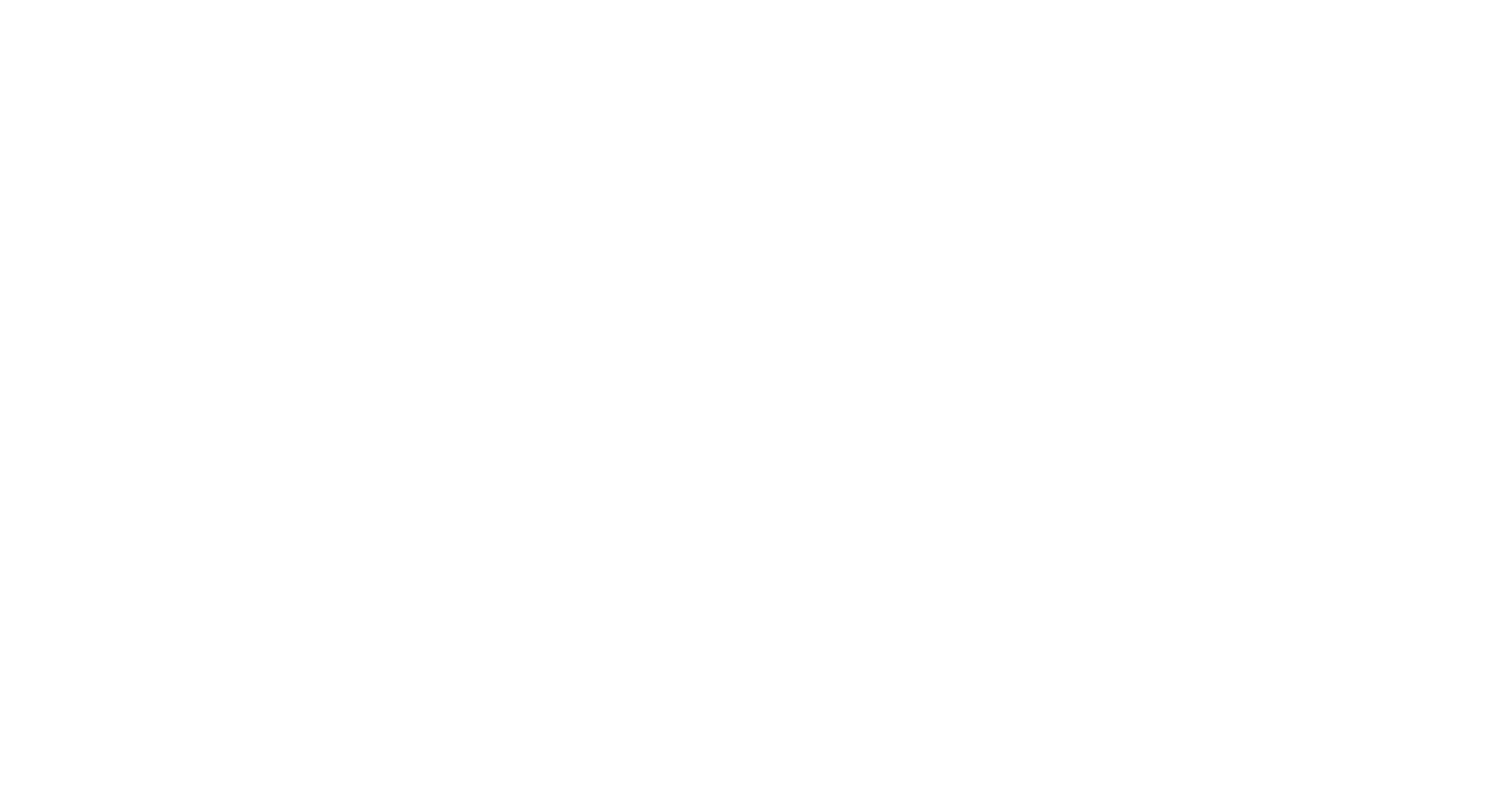

In the Pacific as a whole, the Lowy Institute is warning of a ‘Lost Decade’ due to the pandemic. The impacts are so severe, the report argues, that without support and assistance, the human and developmental deficit created last year will burden us for a generation.

The Lowy paper suggests that a large-scale debt forgiveness programme could help. Vanuatu is better positioned to handle its existing debt, and performance in recent years has exceeded expectations.

The Finance Minister’s assurances that Vanuatu will recoup its losses in a year seem optimistic. He’s not the only one to say so, though. The IMF’s 2021 projections for Vanuatu are more pessimistic, but they too appear to believe that a V-shaped recovery is likely.

Travel and tourism may re-open in the coming year, but that almost certainly won’t happen in the first half of the year. When things will return to normal—if they do at all—is anyone’s guess.

Economic Priorities

Agriculture will remain a focus area as the country seeks to re-base its economic activity to place prosperity in the hands of agriculture workers. There’s a lot still to be done.

The recent pilot project to export taro to New Zealand has still to prove itself. Money exists for at least one more go-round, so time will tell if bulk root-crop exports will prove sustainable.

The Ministry of Agriculture will need to become a lot nimbler if it hopes to avoid a repeat of the debacle that saw farmers stuck with tens of thousands of ripe pineapples and no one to sell them to.

Efforts to rebase the coconut economy on more high-value products (such as virgin oil) are commendable, and arguably easier to sustain, but until global trade and shipping normalise, it’s hard to see how people will make a decent living, let alone thrive.

Other commodities that had seen growth in the past, particularly kava, will likely see a small rebound in the next 12 months, but again, until shipping and trade flows regularise, it’s hard to imagine growers and exporters doing more than treading water.

Fiscal/sectoral intervention will continue, but will be paid mostly from unspent funds from 2020. Finance was overwhelmed by demand during the first rounds. It’s not clear if they’re better provisioned to handle the increased workload for another year.

This is cause for concern. There is evidence that unemployment has risen steadily all year, and that economic hardship is biting deeply into urban households. Job announcements that might have received half a dozen applications in the past are seeing ten times that many today.

Without significant intervention, the number of business failures could jump sharply in the next 9-12 months. There’s not a single business owner in the country today who isn’t worried about the future of their business. Most will be confident about surviving, but a disturbingly large minority are facing an existential crisis.

The knock-on effects of a cascade of business failures seems to be too sensitive for policy makers, who are trying to keep a brave face. If contingencies do exist, they’re not sharing them.

Public Income

The EU, Australia and now China have all announced budget support measures in the form of grants. All told, external development assistance will reach nearly VT 20 billion this year. This will backstop waning tax revenues and provide a degree of confidence as the government continues its ambitious infrastructure rollout.

Citizenship by investment programmes continued to cook along in 2020, with an estimated VT 12 billion in revenue for the year. This represents roughly 70 new approvals every month.

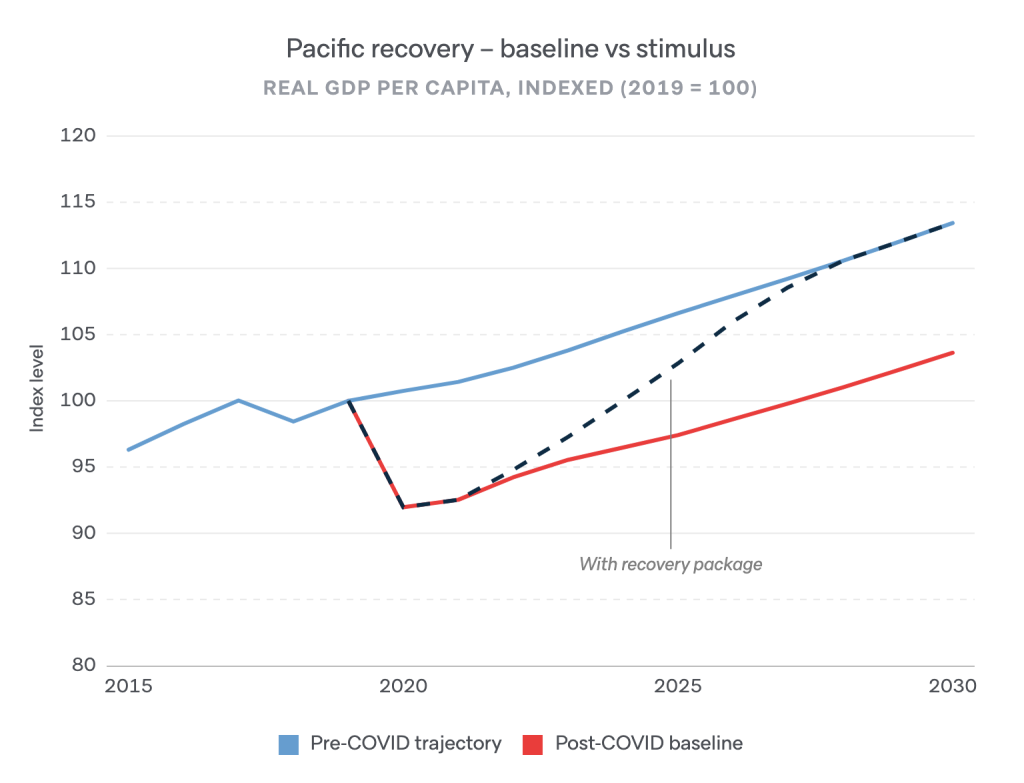

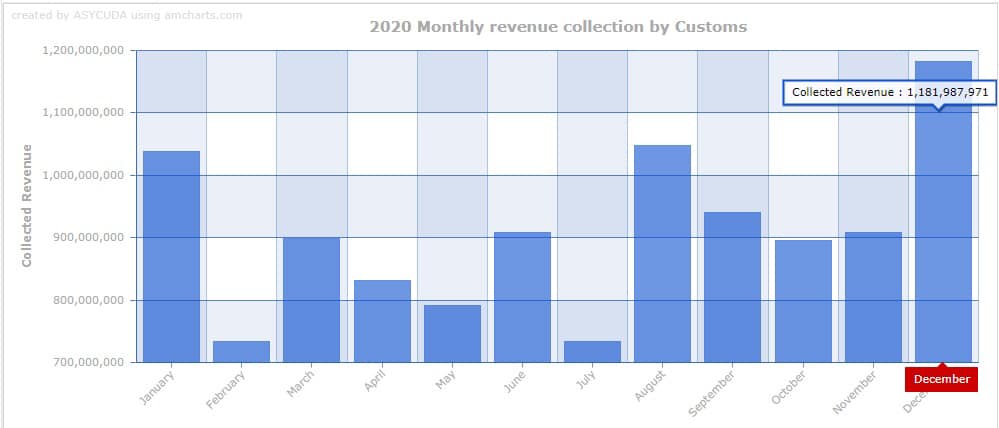

How this compares to VAT isn’t entirely clear. Days before this went to press, Customs & Inland Revenue released a chart showing monthly revenues to the end of 2020.

Using a bar chart showing tax revenues for 2019 for comparison, it appears that tax revenues have dropped considerably, and they fluctuate much more than in previous years.

Beyond that, there’s just not enough data to make a firm statement.

Information Starvation

Finance’s silence is consistent with other public information services. The VNPF has not responded to repeated requests for member numbers and contribution rates. The National Statistics Office latest trade reports date from December 2019.

As things stand right now, it is nigh impossible for members of the public to know the current state of our economy.

Information keeps changing. July’s Half Year Financial Update report stated that GPD growth in the first half of 2020 was 0.6 percent, but when Finance Minister Johnny Koanapo addressed Parliament in November, that number had been revised to -4.1 percent. The growth forecast for 2021 was 4.0 percent in the Half Year report, but by the time the minister spoke, it had reached 5 percent.

The International Monetary Fund appears to contradict both of them, forecasting a -8.3 percent contraction in real GDP for 2021. The IMF’s models overestimate tourism’s role in the economy, and the Fund wasn’t able to conduct an Article IV review last year, due to the pandemic.

But even allowing for a relatively large waffle factor of 3 percent, the IMF’s forecast still seems more plausible.

In the face of unprecedented crisis, no one wants to be the bearer of bad news. But with the economic health of the nation at stake, openness and transparency are needed now more than ever.

Predictions

Tourism

The hole is deeper and wider than anyone thought it would be. Australia’s top health officials are now saying they doubt their borders will re-open this year. That means near-zero incomes for many operators.

Without more fiscal intervention and a much more concessionary financial environment, international chains actors will be forced to make hard decisions about their global operations. These could impact hundreds, even thousands of livelihoods, directly and indirectly.

Locally-owned up-market resorts may be better positioned to weather a prolonged drought, because their community ties will help them and their employees to work together to ensure their collective survival. But this has to be weighed against chronic cash flow, staff, and supply chain management challenges they face. Without help, it’s likely that some of our greatest local success stories won’t survive.

Boutique operations, especially beach-side attractions and guest houses, will be more resilient, but the massive cost of two consecutive dry years might be enough to dissuade them from re-opening. If their priorities change, they may change permanently.

The knock-on impacts on education, nutrition, sanitation and healthcare are considerable. Without a significant investment in community level social services, 2021 could bring real hardship to parts of Sanma and Tafea, as well as rural Efate.

Agriculture

A rebasing is underway to enlarge the role of agriculture in the national economy.

Despite a number of good ideas and a clear goal, an actual strategy has been slow to emerge. Early plans haven’t adapted well to the pandemic.

Nonetheless, continued inflows of domestic and donor support will make agriculture more attractive to many Ni Vanuatu than any other activity. With employment likely to drop drastically, we may see more peri-urban and rural land on Efate placed under cultivation than ever before.

Santo is best positioned to benefit from increased commercial farm activity, with Malekula and Tanna not far behind.

In the face of a piecemeal rollout, those with the most entrepreneurial spirit will be the most likely to prosper.

Travel/Transportation

Heaven help Air Vanuatu.

The airline has suffered mostly in silence since the beginning the pandemic. In hindsight, its ambitious expansion plans could not have been timed worse.

The knock-on effects of the 2018 ATR crash have gone largely un-noted, but the airline’s decision to scapegoat the pilot rather than address the institutional issues that resulted raise serious concerns about its ability to manage even its domestic fleet.

Even before domestic travel restrictions and cyclone Harold threw its inter-island service into a cocked hat, the airline was already under capacity, facing chronic scheduling problems and rising passenger dissatisfaction.

Their newly selected CEO is an old hand. Whether this is the talent the airline needs to avoid an existential crisis remains to be seen.

The potential impact of a failed airline on the national economy is enough to make even the most cold-blooded observer flinch.

International shipping will continue to suffer from global interruptions, and air cargo is almost non-existent. VAT and excise revenues will therefore be extremely volatile for the rest of the year at least.

Domestic shipping and local land transport have covered some of Air Vanuatu’s decline. But lack of regulation is raising real health and safety concerns. One local passenger liner was spotted traveling in reverse with visible flames spouting from its stacks. No enforcement action was taken.

The widespread increase in rural road quality is opening up real opportunities for land transport operators across the country. Improved access to markets is helping farmers nationwide. This is one bright spot in a gloomy year ahead.

Industry & Construction

Small-scale alternative energy generation will continue to grow, fostering a cottage industry in provision and rollout.

Hardware and residential construction in Sanma and Penama provinces will continue apace as these provinces slowly emerge from the chaos of cyclone Harold. School and health centre reconstruction projects will benefit local contractors for years to come.

Nationwide, we should see significant activity as the country’s ambitious infrastructure buildout continues. The degree to which contracting and procurement remain unmarred by graft will be a major determining factor in the impact of these projects on the nation’s economy.

Overall

The coming year will be as hard, if not harder, than 2020. Without major sectoral and financial intervention, those whose plan was just to survive until the new year will be facing a major gut-check. The calendar has rolled over, but nothing’s changed.

Given what we know about the state of affairs globally, regionally and nationally, it’s hard to be optimistic. If we can generate more of the grit we found to survive 2020, we will make it through.

Last year was a write-off. This year may be too. All our time and energy right now should be focused on avoiding what the Lowy Institute calls a Lost Decade.

The Village Explainer is a semi-regular newsletter containing analysis and insight focusing on under-reported aspects of Pacific societies, politics and economics.